food tax in maryland

The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency.

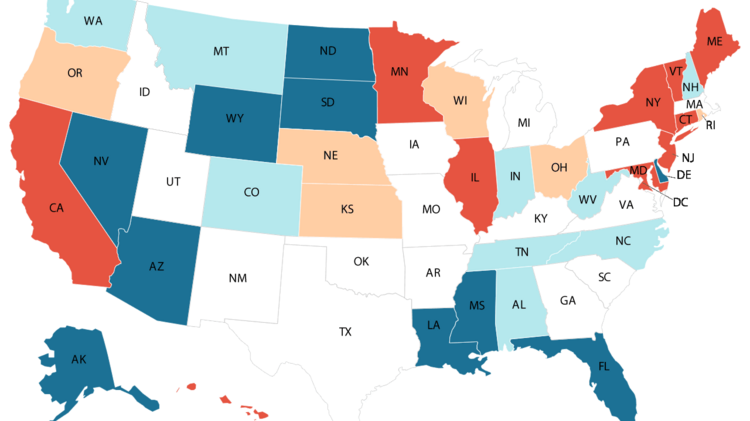

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

However if a grocery store that falls under this category sells prepared foods that can be consumed on the premises or carried out then you will most likely pay a 6 sales tax.

. The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. Food and Beverages FAQs. Sales of alcoholic beverages are taxed at 9.

For example if I go grocery shopping will there be a tax rate. Meal Rates for high cost metropolitan areas C. All sales of food and beverage are subject to the tax except the following cases.

Vendors should multiply their gross receipts by 9450 percent before applying the 6 percent rate to determine the tax due on gross receipts derived from vending machine sales. Sale of beer wine and distilled spirits for OFF PREMISES consumption. The Maryland Food Donation Pilot Program SB 416 was signed into law by Governor Larry Hogan in 2017.

Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Despite opposition from the pet food industry the amended bill passed overwhelmingly in both houses of the Maryland legislature. The 2022 Sales and Use Tax Exemption Certificate renewal process is now available.

Is the food taxed here in Maryland. An interesting development in 2013 state legislation was Marylands passage of SB 820 which imposes a fee on pet food to fund a statewide spay-neuter program aimed at low-income communities. To learn more see a full list of taxable and tax-exempt items in Maryland.

Meal Incidental Expenses MIE Reimbursement Rates for FY 2023 A. For example if I go grocery shopping will there be a tax rate. Every time you purchase taxable tangible goods from businesses outside of Maryland whether in person over the phone or on the Internet the purchase is subject to Marylands 6 percent use tax or 9 percent alcoholic beverage tax if you use the merchandise in Maryland.

Unclaimed Property Holders required to file by October 31. Does anyone know what items arent taxed here in MD. It allows farmers to donate eligible food in return for a tax credit against State income taxes.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland FoodBeverage Tax. Marylands use tax protects Maryland businesses from unfair competition. In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream.

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. All sales of food and beverage are subject to the tax except the following cases. Truck rentals are taxed at 8.

Rates - Maryland taxes various goods and services at different rates. The sales and use tax does not apply to sales of snack food items by a. Posted by 1 year ago.

The reimbursable rate is 100 per bag. Sale of candy or confectionery. Sale of beer wine and distilled spirits for OFF PREMISES consumption.

Porter fees and hotel tips. Standard Meal Allowance for FY 2023 including Tax and Tip Breakfast1500 Lunch1800 Dinner30 00 B. The 9 tax amount must be listed separately from the 6 tax amount on the bill of sale.

Sale of candy or confectionery. Is the food taxed here in Maryland. How are Sales of Food Taxed in Maryland.

A 6 tax rate applies to most goods and services. If you make a tax-free purchase out of state and need to pay Marylands 6 percent use tax you should file the Consumer Use Tax Return. This page describes the taxability of food and meals in Maryland including catering and grocery food.

Business Tax Tip 27 Sales and Use Tax Exemption for Caterers Introduction In general a licensed caterers charges for food beverages and any services provided for a customers specific event are subject to sales tax. How is food taxed. However vehicle rentals and the sale of alcoholic beverages are taxed at different rates.

Every time you purchase taxable tangible goods whether in person over the phone or on the Internet the purchase is subject to Marylands 6 percent sales and use tax if you use the merchandise in Maryland. This is why you wont have to pay a Maryland food tax on a box of crackers. In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by a person operating a substantial grocery or market business and is not a taxable prepared food.

If you are not a licensed caterer as defined below the exemptions detailed in this section are not applicable. The program was originally launched exclusively in Southern Maryland and Montgomery County but was expanded statewide and will now continue. Catering TAXABLE In the state of Maryland any voluntary gratuities that are distributed to employees are not considered to be taxable.

Car and recreational vehicle rentals are taxed at 115. Groceries and prescription drugs are exempt from the Maryland sales tax Counties and cities are not allowed to collect local sales taxes Maryland has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The tax must be separately calculated on sales of alcoholic beverages at the 9 rate and on sales of food non-alcoholic beverages and other merchandise at the 6 rate.

How To Get A Clothing Donation Tax Deduction

Mpmpmom And Pops Reprint Menu1 Pop

Exemptions From The Maryland Sales Tax

Sales Tax On Grocery Items Taxjar

Auction To Raise Money For A Thanksgiving Dinner Fund For Families In Need How To Raise Money Thanksgiving Baskets Silent Auction

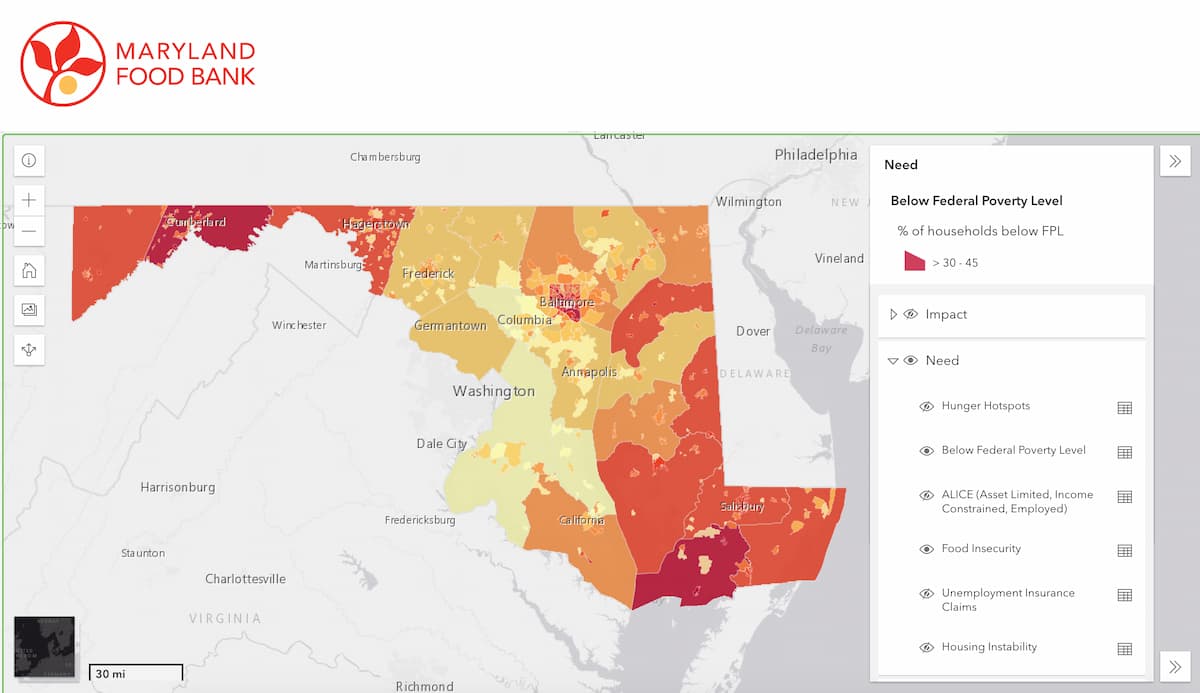

Research And Reports Maryland Food Bank

Kroger Private Selection Maryland Style Crab Cakes Crab Cakes Baked Fries Crab Cake Sliders

Nonprofit 501 C 3 Articles Of Incorporation How To Write With Sample Non Profit Writing Articles

Maryland Cottage Food Law Forrager

How To Maximize The Benefits Of Donating To A Charity Annapolis Md Estate Planning Attorneys

Maryland Agriculture Has It All Usda

Maryland Crab Dip With Breadsticks Maryland Crab Dip Crab Recipes Crab Dip